Life Insurance in and around Lexington

Protection for those you care about

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Fayette County

- Richmond

- Georgetown

- Versailles

- Nicholasville

- Winchester

- Central Kentucky

- Paris

- Lawrenceburg

- Harrodsburg

- Lancaster

- Danville

- Berea

- 40503

- Kroger Field

- Nicholasville Road

- University of KY

- 40502

- 40508

- UK campus

- 40507

- 40515

Your Life Insurance Search Is Over

State Farm understands your desire to care for the people you're closest to after you pass away. That's why we offer outstanding Life insurance coverage options and caring compassionate service to help you opt for a policy that fits your needs.

Protection for those you care about

Life happens. Don't wait.

Wondering If You're Too Young For Life Insurance?

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you select will depend on your current and future needs. Then you can consider the cost of a policy, which depends on your age and your health status. Other factors that may be considered include gender and family medical history. State Farm Agent Debra Hensley can walk you through all these options and can help you determine what type of policy is appropriate.

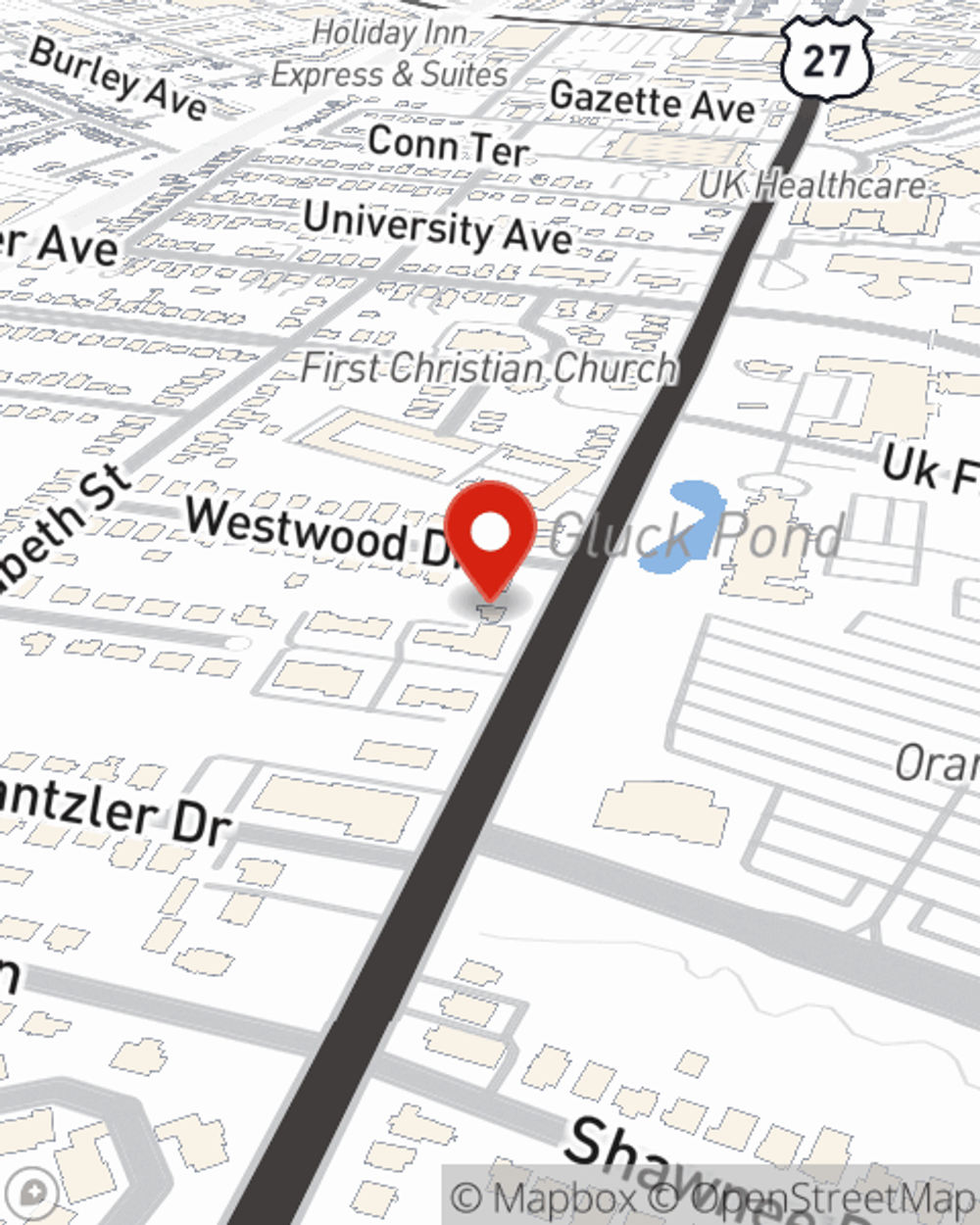

Get in touch with State Farm Agent Debra Hensley today to see how a State Farm policy can care for those you love most here in Lexington, KY.

Have More Questions About Life Insurance?

Call Debra at (859) 276-3244 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Debra Hensley

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.